Gallo: The good, the bad and the unknown of Biden’s student loan cancelation

Wiki Commons CC 3.0 us [Fair Use]

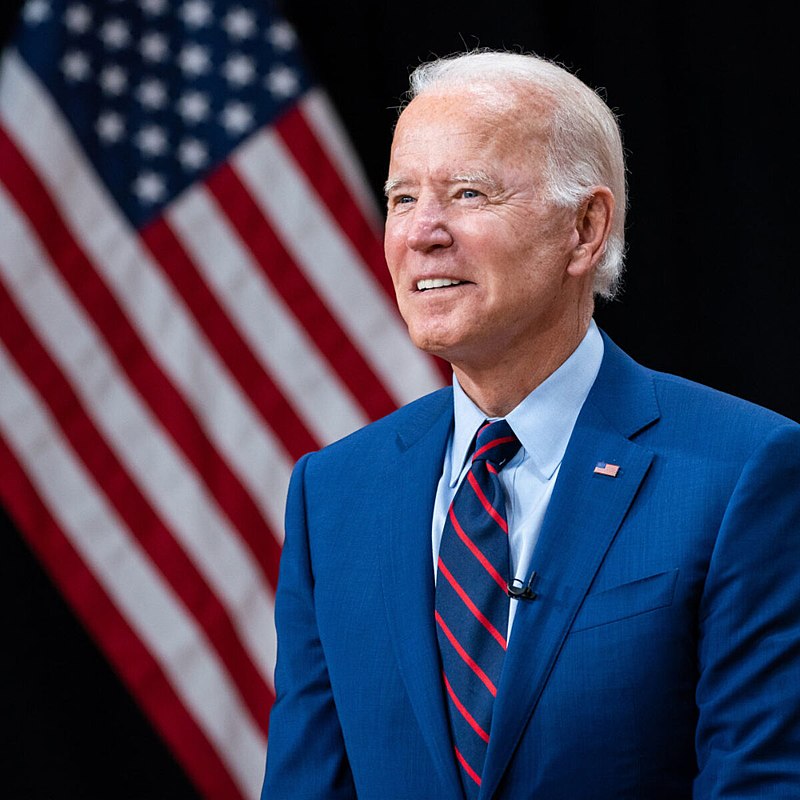

President Joe Biden presents his plan to relieve college student debt for millions of Americans.

October 1, 2022

President Joe Biden has finally met his campaign promise to cancel student loans. Opinions are mixed. Some people love it, some don’t think it’s fair and some don’t think it’s enough. No matter what, though, this decision impacts millions of Americans, from retirees to high schoolers like us. Student loans have tripled to $1.7 trillion in the last 20 years, so canceling even some of it is a huge step. But what did President Biden do? How does he have the authority to do this?

The president’s plan would revoke up to $10,000 of student debt for anyone making less than $125,000 per year or a household making less than $250,000. Additionally, anyone who received a Pell Grant — financial aid for low income college applicants — could have up to another $10,000 revoked. Notably, this only applies to federal loans, not private ones. Still, this could affect roughly 43 million Americans. The authority he has to do this is based on a 2003 law called the HEROS Act, which states the president has the power to cancel student loans during a national emergency, such as the COVID-19 pandemic. However, many argue this is an overreaching abuse of power that will likely bring legal challenges.

Assuming the plan does go through, what are the economic implications? Economists disagree, but it will definitely affect inflation. The highest estimates are a 0.3% increase, although some economists believe inflation will still decrease because the COVID pause on student loan payments will end in January. Inflation is currently at 8.5%, the highest since 1982, so any potential increases warrant concern. I certainly wonder if this is simply not the best time.

Another aspect to consider is who benefits from the loan cancellation. Almost 50% of student loans are owed by 1% of borrowers, yet they are also the people who are most likely to have a job paying six figures and paying off the debt easily. Most people who would have their debt canceled are under constant risk of defaulting on their much smaller loans. In that sense, I applaud the choice the president made to target the people who need help. It will ease the burden and avert potential bankruptcy for millions. Still, it does only benefit those who went to college. It does nothing to aid hard-working, blue-collar Americans struggling under that same inflation rate.

Finally, we must examine the future implications of the policy. Will colleges increase tuition in the future, and what will the government do to decrease it?

The first part is simple. Colleges could see the government forgiving debt and use it as an excuse to drive up tuition rates and profit even more. Tuitions have already more than doubled since the 1970s, so anything that could cause more price hikes is concerning.

The second bit is more interesting. What does this do to fix the problem that college is too expensive? Absolutely nothing. College is still a massive money sink, and canceling existing debt doesn’t solve that. As a high school junior, this worries me because very soon my numbers will be added to that. Will there be another one of these cancellations for me, or am I stuck with the rising prices as I apply to colleges next year?

This policy of a one-time cancellation is great aid for struggling Americans. It allows for many people to earn their wages and keep money that would otherwise go to paying off a degree they earned years ago. Not to mention, it is obviously a good political move two months before the midterms. However, it does nothing to help future generations. Any effect this cancellation has will be negated as soon as more people get accepted into college. In that respect I ask: What’s the point? What’s the point of jumping through all the hoops of whether Biden has the authority, inflationary uncertainty and the risk of colleges responding negatively? What’s the point if the effects are so temporary that I will not see the benefits in just two years? This cannot happen again without risking major inflation hikes. To put it simply: This is a great policy that is completely unsustainable.